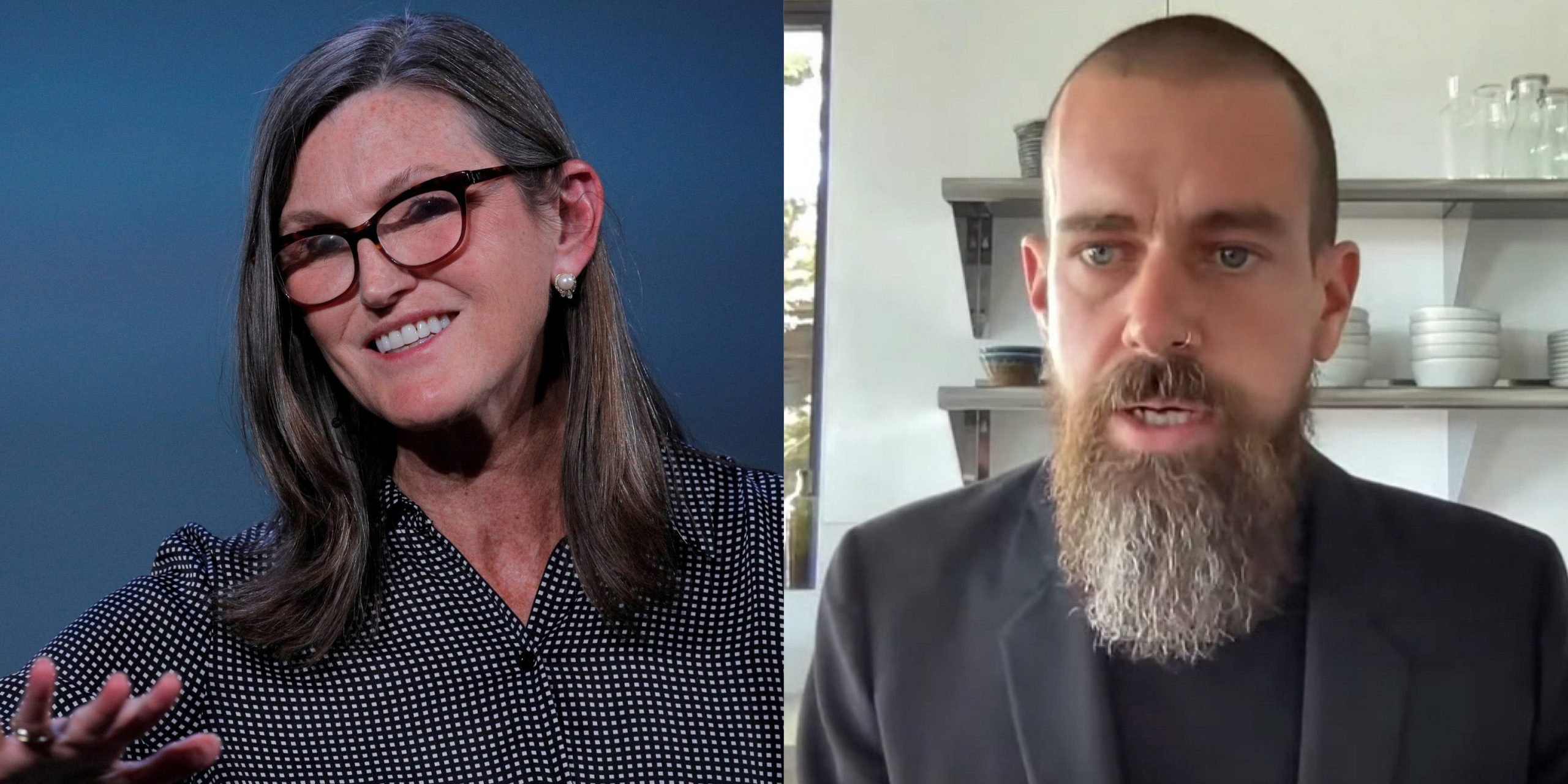

CEO Jack Dorsey

REUTERS/Brendan McDermid/File Photo/File Photo (Wood). U.S. House of Representatives Energy and Commerce Committee/Handout via Reuters (Dorsey).

- Cathie Wood took to Twitter to detail three deflationary forces that will "overcome the supply chain-induced inflation."

- She said technological innovation, creative destruction, and cyclical factors will rein in inflation.

- Her tweet came less than 72 hours after Jack Dorsey sounded an alarm on rising prices.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Cathie Wood on Monday took to Twitter to detail three deflationary forces that will "overcome the supply chain-induced inflation," responding to Jack Dorsey less than 72 hours after he sounded an alarm on rising prices.

On October 22, Twitter founder and CEO Dorsey said: "Hyperinflation is going to change everything. It's happening."

The post went viral with over 73,000 likes and 25,000 retweets. Notable comments included MicroStrategy CEO Michael Saylor who said bitcoin is the solution to inflation and economist Peter Schiff who slammed bitcoin and touted gold.

Wood, the founder and CEO of Ark Investment Management, rebutted Dorsey with a 12-part tweet, starting with a misconception she had in 2008, when the Federal Reserve started its quantitative easing following the global financial crisis.

"I thought that inflation would take off. I was wrong," she said. "Instead, velocity – the rate at which money turns over per year – declined, taking away its inflationary sting. Velocity still is falling."

Wood said the three roots of deflation will be:

- Technologically enabled innovation, which will be the "most potent source." This includes artificial intelligence, an industry whose training costs have been dropping 40%-70% at an annual rate, in what she called a record-breaking deflationary force. "AI is likely to transform every sector, industry, and company" over the next 5-10 years, she said.

- Creative destruction due to disruptive innovation. Many companies, she said, have catered to short-term-oriented shareholders who mainly seek profit, instead of investing in innovation. These companies "will be forced to service their debts by selling increasingly obsolete goods at discounts: deflation," she added.

- Cyclical factors. After shutting down, many business are still catching up to consumer demand that surged during the pandemic and are likely ordering double or triple what they typically need. But she predicted that wave will pass. "Once the holiday season passes and companies face excess supplies, prices should unwind," she said, adding that some commodity prices such as lumber and iron ore have dropped 50%.

She also said oil demand is below 2019 levels, and rising prices should weaken it. Meanwhile, the ESG trend is forcing energy companies to shift investments toward renewables, and banks are lending less to the sector. Plus, electric vehicles are taking off, "sowing the seeds of a serious oil price decline longer term."